Get Pre-Qualified Before You Find the House

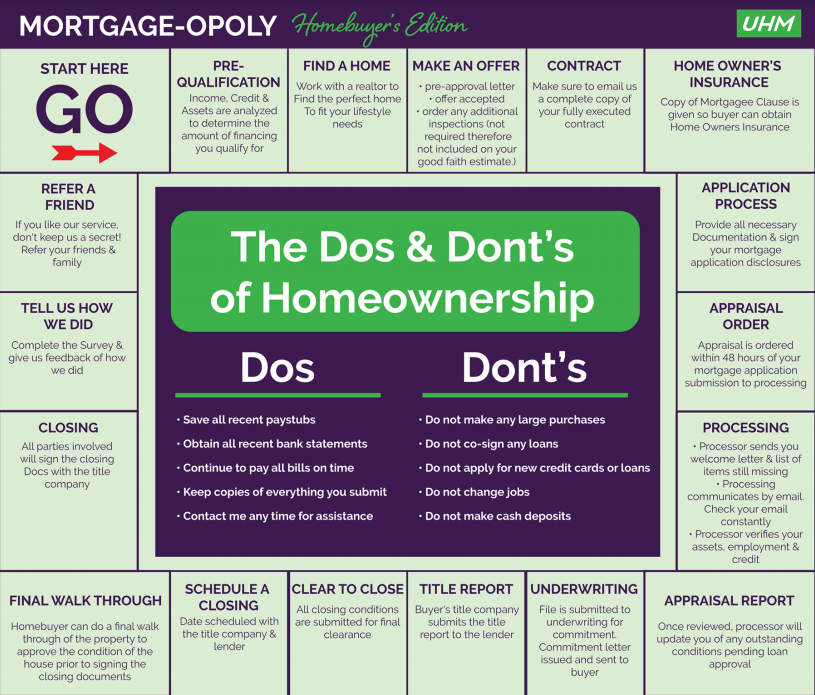

The mortgage process begins before you even make an offer on a house, and getting a pre-qualification is the first step you should take before shopping for a home. Knowing how much house you can afford responsibly and the loan you qualify for is important, as it will help you and your real estate agent (you’ll need one of those, too!) know where to start when searching for your perfect home.

Once you’ve found a house you love that fits all your needs and lifestyle, it’s time to submit an offer. There may be some back and forth negotiating between you and the seller, but it’ll all be worth it once your offer gets accepted. While you're one step closer to the home of your dreams, now comes the inspections, contract, and next steps in the mortgage process.

The Mortgage Process Gears Up

Once you receive your contract, be sure to send a copy to your loan officer. A copy of the Mortgage Clause is also provided so you can obtain a homeowners insurance policy for your new house. You’ll then need to provide all necessary information and documentation in your application and sign the disclosures. Within 48 hours of submitting your application to processing, there will be an appraisal ordered on the property you wish to purchase. You’re not done playing Mortgage-Opoly quite yet - next comes processing!

Check Your Email

During processing, you will receive emails from the loan processor detailing all additional information needed, as well as a welcome letter and updates throughout the process. The processor will verify your assets, employment and credit. Be sure to check your email diligently during this stage, as it may help speed up the process!

Next, you’ll receive the appraisal report, and if there's any outstanding conditions pending the loan approval, the processor will inform you.

Underwriting will then evaluate the file for commitment and send a commitment letter to you, so you can move forward into title and closing.

Closing Begins

Finally, closing begins! First, the title company you’re working with submits the title report to the lender. Once all closing conditions are submitted, you’ll get final clearance to close on your new home. Now it's finally time to schedule your closing! Before you sign the contract, you are entitled to a final walk through of the home, to approve of the condition it is in. If all is good to go, you’re clear to sign the contract! All parties involved sign the closing documents with the title company.

Welcome Home

Congratulations on your new home! You've signed on the dotted line and completed your journey through Mortgage-Opoly! Don’t forget to provide your loan officer with valuable feedback about your experience. If you’re raving about your service with UHM, be sure to refer a friend (or two!).